do nonprofits pay taxes on rental income

We never bill hourly unlike brick-and-mortar CPAs. A charity may have rental income and so long as the property is not subject to a mortgage and the owner is not.

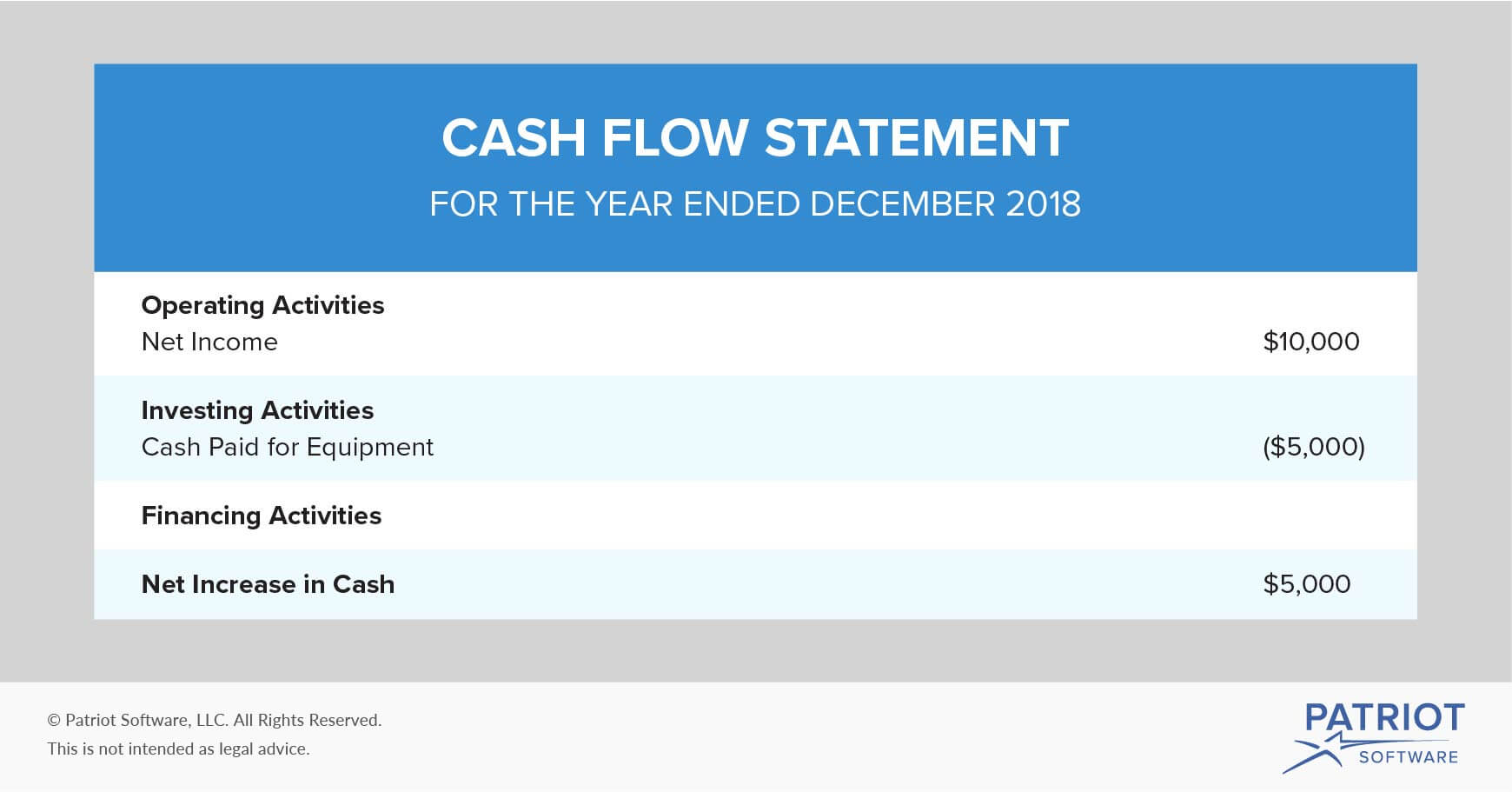

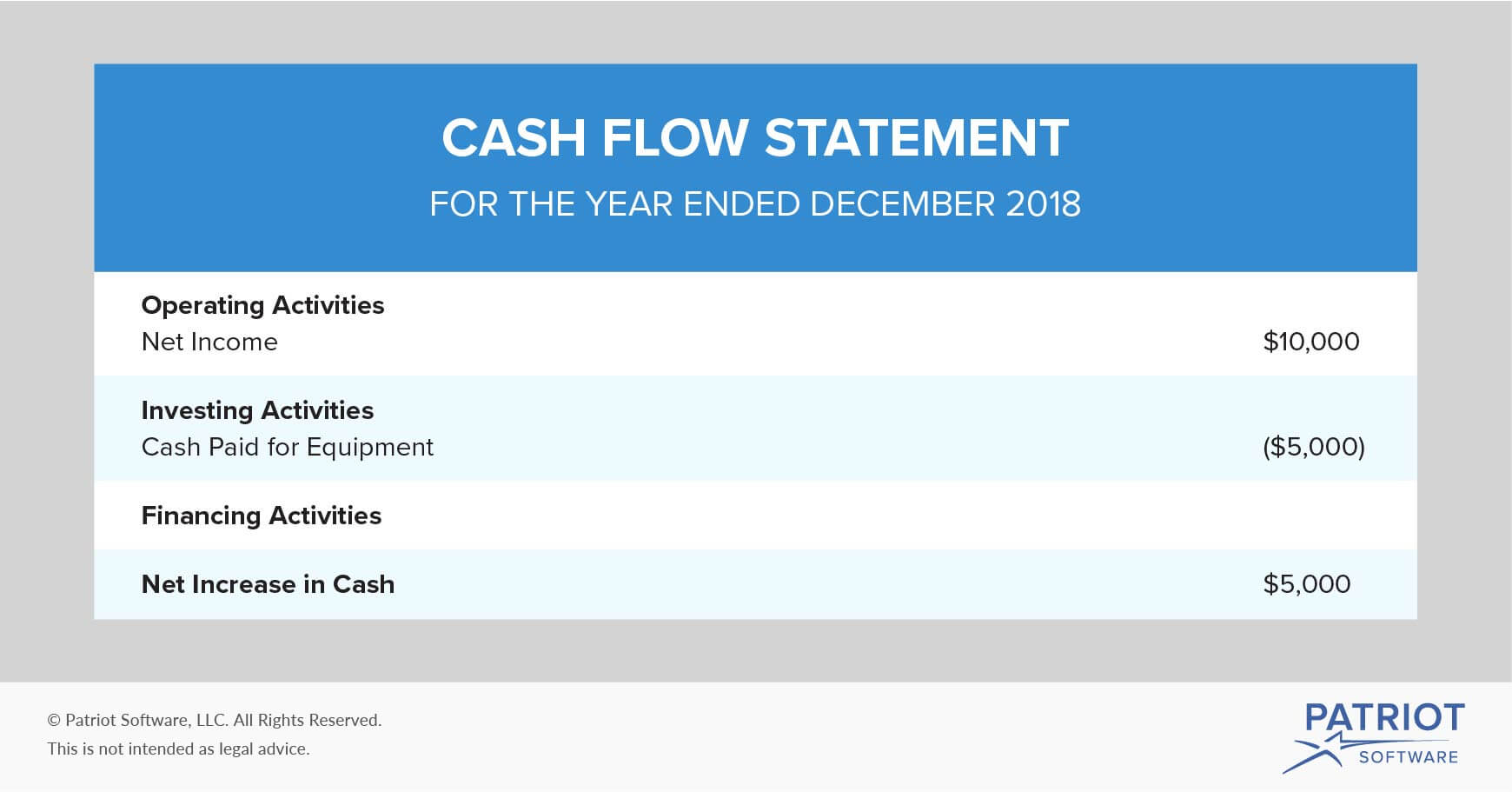

Accounting Spreadsheets And Document Examples Nonprofit Accounting For Volunteers Treasurers And Bookkeepers

UBTI is subject to unrelated business income tax UBIT.

. If you do not rent your property to make a profit you can deduct your rental expenses only up to the amount of your rental income. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations.

Your annual tax bill is calculated by multiplying the assessed value of the. Generally the first 1000 of unrelated income is not taxed but the remainder is Lets go back to the Friends of the Library. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

There are clear rules as well as several exceptions to. The nonprofit wont have to pay taxes on any profits it receives because the activities that generated the profits were directly. Property Tax Rates Explained.

Before we can explain two scenarios in which nonprofits have to pay UBIT lets review the definitions of UBTI and UBIT. The IRS applies a similar rule to capital gains on the sale of real estate. In New Hampshire those private donations amount to just 185 percent of the state taxpayers adjusted gross income or a total of just under 550 million.

Report your not-for-profit rental income on Form 1040 or 1040NR. And while churches are not allowed to. Factors that determine whether the income is taxable include whether the tenants activities are.

All other tax breaks and incentives including property tax have to be applied for individually. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. That means any unused money at the end of the period gets taxed as well.

5 A nonprofit can jeopardize its exempt status by earning too much income that is unrelated to its mission. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits. The nonprofit could properly use the income it generates from these activities to pay operating expenses and employee salaries.

The tax treatment of the gains depends on whether the property. Rental income by itself should not jeopardize your organizations federal 501 c 3 charity status. The research to determine whether or not sales tax is due lies with the nonprofit.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. If a nonprofit runs an unrelated business to raise money -- one thats not part of the core mission -- the unrelated business income is taxable.

Once a nonprofit has incorporated and received its tax exempt number it is automatically exempt from corporate income tax only. Exempt nonprofits generally do not have to pay taxes on their incomes but some types of income are taxable. Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

These include Federal Income Tax Withholding FITW Social Security and Medicare FICA and State Unemployment Taxes SUTA. The amount was 1110 in 2019 is taxable. For instance HOAs that file this form experience a lower tax rate 15 for the first 50000 of net income.

Only incorporated nonprofits with IRS-issued tax exempt numbers can avoid paying taxes. Understandably most charities in the. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

One source of UBI is rental income. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function. The nonprofit generates income by conducting charity dinners raffles and fundraisers.

Taxable if Income from any item given in exchange for a donation that costs the organization not the customer more than a certain amount to obtain based on 5 in 1987. To be tax exempt most organizations must apply for recognition of. Depending on the circumstances the rental income might be considered unrelated business income a taxable income category for nonprofits.

In a nutshell nonprofits can make up to 1000 of unrelated income before they have to pay taxes on it. On the downside though it subjects all of your associations net income to taxation. Federal Tax Obligations of Non-Profit Corporations.

Anything more will require the nonprofit to pay both state and federal corporate income taxes. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. This guide is for you if you represent an organization that is.

Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code. The nations average rate is 107 which is pricey compared to Europe and the rest of the world. Enjoy flat rates with no-surprises.

While this may look like a lot of money in the aggregate New Hampshires giving as a percentage of income is about the lowest in the United States. The only income the nonprofit would derive is the rental income with no share or participation in the for-profits activities. However this corporate status does not automatically grant exemption from federal income tax.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. However not all rental income is subject to unrelated business income tax UBIT. 501c3 tax-exempt nonprofit organizations are exempt from paying Federal Unemployment Taxes FUTA but will have to either pay into their states unemployment program or opt-out and directly pay any unemployment.

While most nonprofits do have exempt status they can still be subject to tax if they have unrelated business taxable income UBTI. RAB 2016-18 Sales and Use Tax in the Construction Industry. Even tax-exempt nonprofits sometimes earn taxable income.

There are both pros and cons to using this form. You cannot deduct a loss or carry forward to the next year any rental expenses that are more than your rental income for the year. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

Even though the federal government awards federal tax-exempt status a state can require additional documentation to. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act.

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

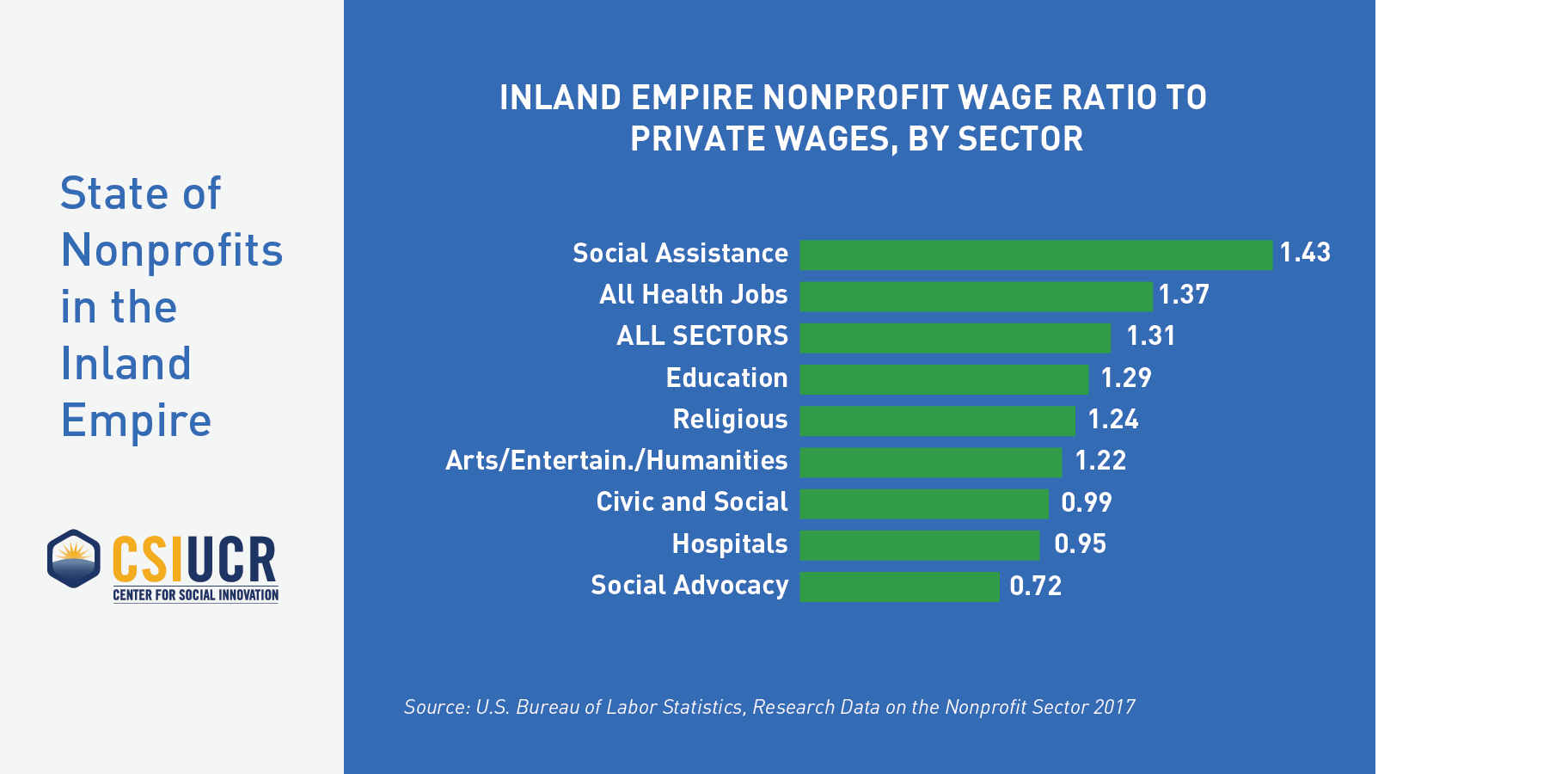

State Of Nonprofits In The Inland Empire Center For Social Innovation

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

Unrelated Business Taxable Income For Nonprofits Sd Mayer

Form 990 Guide To Filing Instructions For Nonprofits Araize

Common Nonprofit Unrelated Business Income Types

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping

A Guide To Tax Filing Requirements For Nonprofit Organizations

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

When Nonprofits Are Taxed On Unrelated Business Income

Property Tax Exemptions For Nonprofits Blue Co Llc

Taxable Activities Of Nonprofits A Basic Guide To Ubit Wegner Cpas

Misuse Of Funds Nonprofit Help Fraudulent Misappropriation

Accounting For Nonprofit Organizations Financial Statements Beyond

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Guide To Tax Deductions For Nonprofit Organizations Freshbooks